Business

Naira crashes, hits N1,400 per dollar at black market

Yesterday, the Nigerian naira experienced a significant decline, reaching a historic low of N1,370 per dollar in the parallel market, edging closer to the N1,400/$ mark. This depreciation was primarily attributed to a reduction in the supply of dollars from various sources, including the Central Bank of Nigeria (CBN), authorized dealers (mainly commercial banks), and autonomous market channels.

On Tuesday, the local currency was trading at N1,365/$ in the parallel market, showing relative stability at the official market, where it maintained an exchange rate of N882/$, as reported by data from the FMDQ Exchange.

Tamiu Abiodun, a Bureaux De Change (BDC) operator in central Lagos, expressed concerns that the naira’s downward trend would persist unless there is an immediate policy shift to boost dollar liquidity. He emphasized that the current situation is driven by an increasing demand for dollars without a corresponding supply from authorized dealers or the Central Bank of Nigeria.

Despite a rise in crude oil prices, with Brent trading at $79 per barrel following the Energy Information Administration’s (EIA) forecast of tighter markets due to reduced OPEC+ output, the naira’s decline continued.

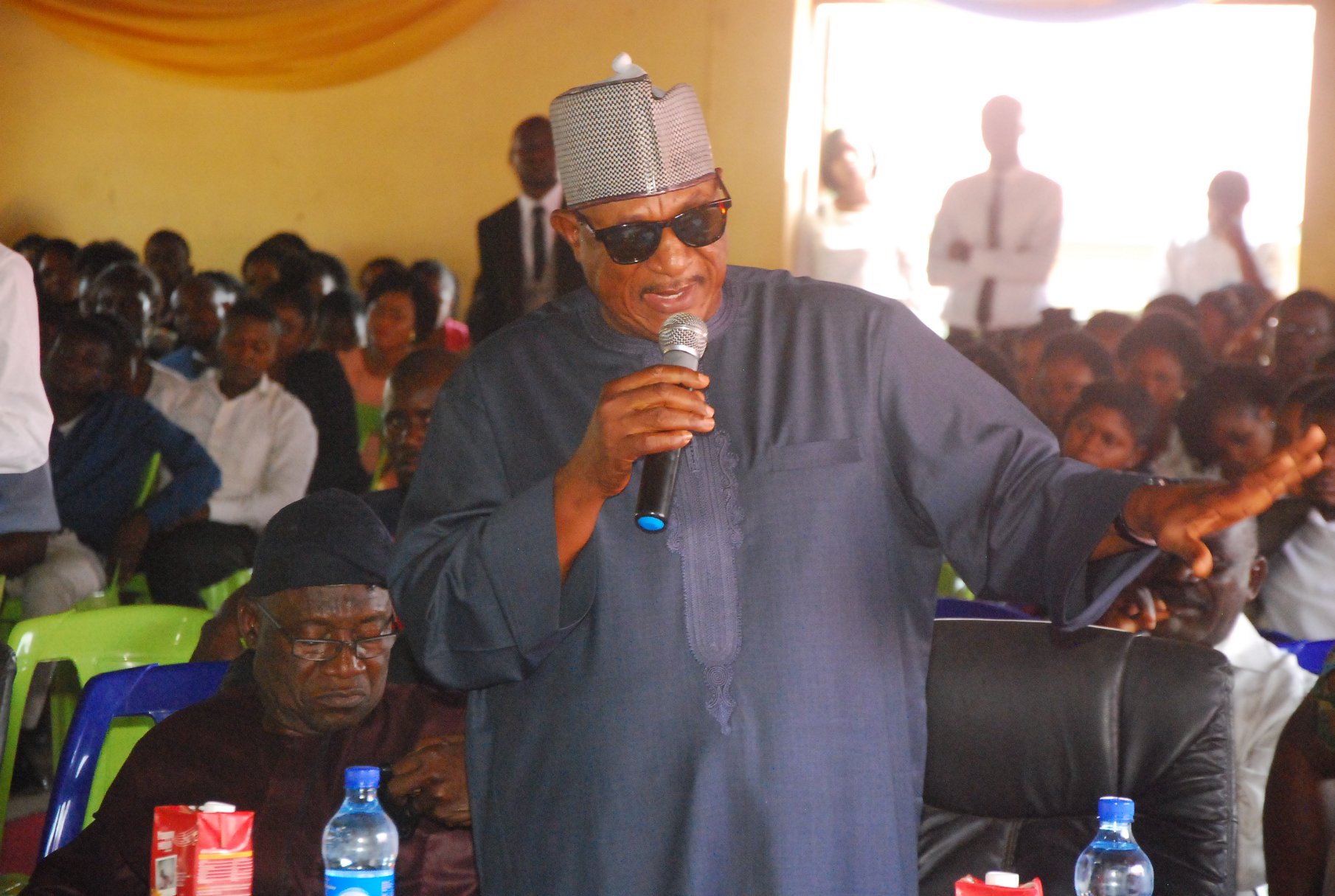

Dr. Aminu Gwadabe, President of the Association of Bureaux De Change Operators of Nigeria (ABCON), urged the Federal Government to enhance financial intelligence and track individuals with proceeds of corruption to cleanse the forex market. He argued that the depreciation of the naira is not solely influenced by the forces of demand and supply but is a collective result of manipulative actions by individuals with illicit funds, putting undue pressure on the foreign exchange market.