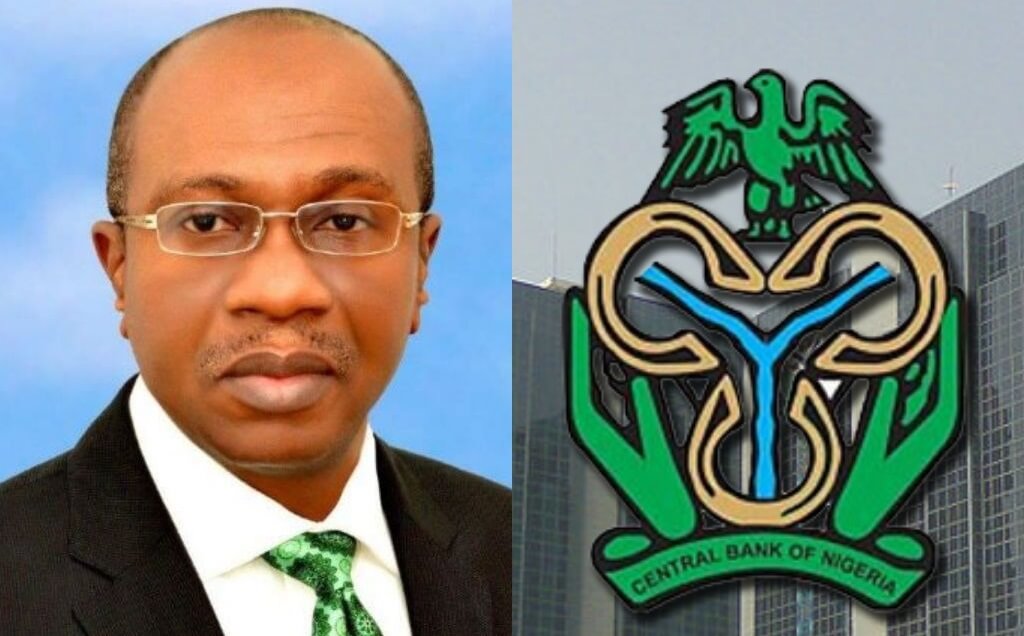

The Central Bank of Nigeria has issued the regulatory framework for Open Banking in Nigeria in its efforts to enhance data sharing across the banking and payments system to promote innovations and broaden the range of financial products and services available to bank customers.

This was disclosed in a recently released circular titled ‘Operational guidelines for open banking in Nigeria’.

Open banking is a banking practice in which third-party financial service providers are given open access to customer banking, transaction and other financial data from banks and non-bank financial institutions via application programming interfaces (APIs).

Open banking can transform the banking industry’s competitive landscape and user experience by allowing more personalized financial products and services to be offered.

The CBN said, “The Regulatory Framework for Open Banking in Nigeria established principles for data sharing across the banking and payments system to promote innovations and broaden the range of financial products and services available to bank customers.”

The CBN stated that the guideline to data in the financial sector would enable customers to access innovative financial products and services “open banking recognises the ownership and control of data by customers of financial and non-financial services, and their right to grant authorisations to service providers to access innovative financial products and services. This is anticipated to drive competition and improve access to banking and payments services.”

CBN added, “Participants in open banking shall adhere strictly to security standards when accessing and storing data, and shall be subject to minimum privacy standards, operational standards, risk management standards and customer experience standards as prescribed by the Bank.”

The CBN stated that the open banking proposition allows any organisation that has data of customers which may be exchanged with other entities to provide innovative financial services within Nigeria, to be eligible to participate in the Open Banking ecosystem.

Rice, a staple for Christmas celebrations in Nigeria, has become a luxury this year. Soaring…

Panic erupted on Saturday at a concert in Lagos when the stage collapsed during Odumodublvck’s…

The Federal Government of Nigeria has allocated ₦6,364,181,224 billion for the refurbishment and rehabilitation of…

The black market dollar to naira exchange rate for today, 22nd December 2024, can be…

The Nigerian National Petroleum Company Limited (NNPCL) has refuted claims that the 60,000 barrels per…

Manchester City finds itself in unprecedented turmoil, with relegation-level form showing little sign of improvement.…