Nigeria News

Gtbank drags Zenith bank to court over debt

Guaranty Trust Bank (GTBank) has taken legal action against over 60 top executives from 13 commercial banks due to an ongoing dispute with Afex Commodity Exchange regarding a N17 billion Anchor Borrowers Programme loan. The executives, including chairmen, CEOs, directors, and company secretaries, are facing contempt proceedings for allegedly not enforcing a No-Debit Order on Afex Commodity Exchange’s accounts.

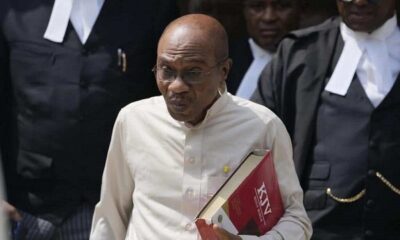

In the case, identified as suit no FHC/L/CS/911/2024, the Federal High Court in Lagos, under Justice CJ Aneke, ordered the jailing of the bank executives for failing to comply with a court ruling from May 27, 2024.

This order affects executives from Access Bank, Citibank, Jaiz Bank, Union Bank, Fidelity Bank, First Bank of Nigeria Plc, First City Monument Bank, NDIC (liquidator for Heritage Bank), Polaris Bank, Stanbic IBTC Bank, Standard Chartered Bank, Taj Bank, United Bank for Africa, and Zenith Bank.

The court had directed 20 banks to transfer funds from the respondent’s accounts to Afex’s account with GTBank until the N17.81 billion debt is repaid. This debt includes N15.77 billion outstanding as of April 17, 2024, and N2.04 billion in recovery costs.

Additionally, the court granted GTBank the right to take over 16 warehouses owned by Afex across seven states and to sell the commodities stored within, which were procured using the Central Bank of Nigeria (CBN) Anchor Borrowers’ loan facility.

Earlier, the court had issued contempt proceedings against Afex and several of its key officers, including Ayodele Balogun, Jendayi Fraaser, Justin Topilow, Mobolaji Adeoye, and Koonal Ghandi. Afex had obtained the Anchor Borrowers Programme Loan from GTBank to finance smallholder farmers, with repayment expected from the sale of commodities. However, Afex failed to meet the repayment terms despite an extension.

Afex claims to have repaid about 90% of the loan, stating that economic challenges have affected their ability to collect repayments from farmers. They have called on the CBN to activate a collateral guarantee clause in the Anchor Borrowers Programme, which covers up to 70% of the loan.

The CBN introduced the Anchor Borrowers Programme in 2015 to link smallholder farmers with processors, increase agricultural output, and stabilize food prices. The programme guidelines require farmers to repay loans with produce, covering both principal and interest. By 2022, approximately 4.8 million individuals had benefitted from the programme, with the CBN disbursing N1.079 trillion, of which over N500 billion is due for repayment. The CBN has since ended the programme to focus on its core mandate of price and monetary stability.