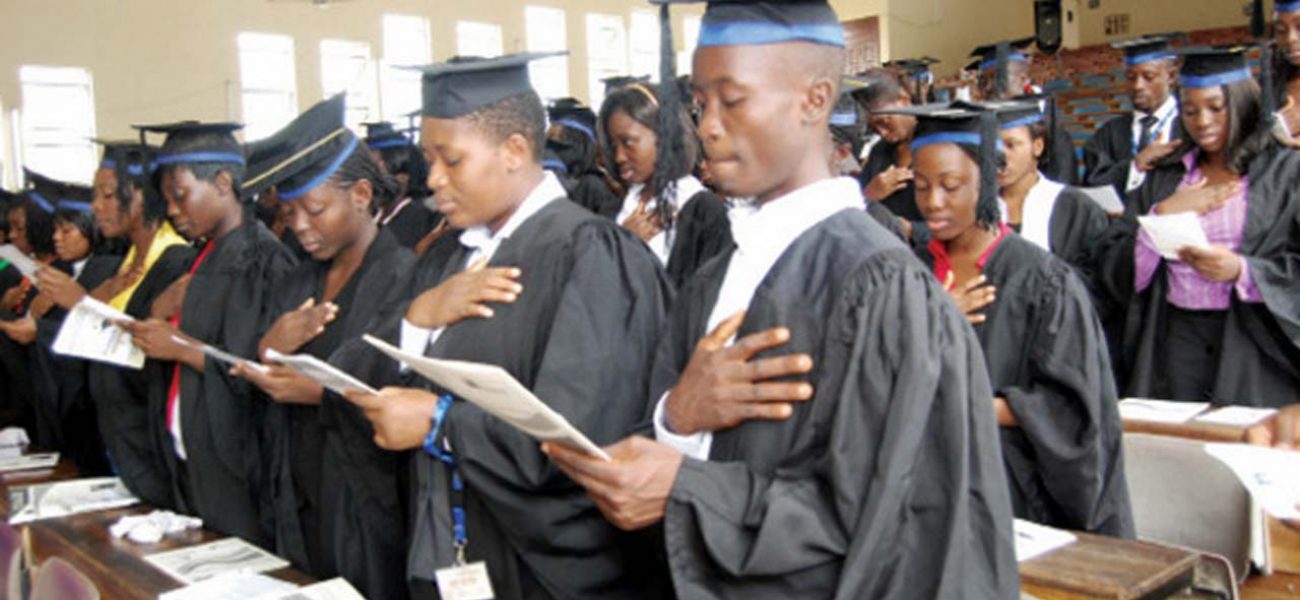

Education

Latest news on FG student loan approval, disbursement today 21st May 2024

The long-awaited student loan program will launch on Friday, benefiting 1.2 million students in federal tertiary institutions across the country, announced Akintunde Sawyerr, Managing Director/Chief Executive Officer of the Nigeria Education Loan Fund.

During a pre-application sensitization press conference in Abuja on Monday, Sawyerr revealed that students in federal universities, polytechnics, colleges of education, and technical colleges would benefit from the initial phase.

Data from the National Universities Commission website shows Nigeria has 226 federal tertiary institutions, including 62 universities, 41 polytechnics, 96 monotechnics, and 27 colleges of education.

On April 3, President Bola Tinubu signed the Student Loans (Access to Higher Education) Act (Repeal and Re-Enactment) Bill, 2024, into law. This followed the Senate and House of Representatives’ approval of the Committee on Tertiary Institutions and the Tertiary Education Trust Fund’s report.

The new Act, titled ‘A bill for an Act to repeal the Students Loans (Access to Higher Education) Act, 2023 and Enact the Student Loans (Access to Higher Education) Bill, 2024 to Establish the Nigerian Education Loan Fund as a body corporate to receive, manage and invest funds to provide loans to Nigerians for higher education, vocational training and skills acquisition and related matters,’ was signed in the presence of National Assembly leaders, ministers, and major education stakeholders.

The Act authorizes the Nigeria Education Loan Fund to provide loans to qualified Nigerian students for tuition, fees, charges, and upkeep during their studies in approved public tertiary institutions and vocational and skills acquisition establishments.

The new law repeals the Student Loan Act, 2023, removing the family income threshold so students can apply for loans and take responsibility for repayment, according to the Fund’s guidelines.

President Tinubu emphasized the inclusive nature of the initiative, stating, “No one, no matter how poor their background is, will be excluded from quality education and the opportunity to build their future.”

The government initially planned to launch the scheme in September but faced delays. The Presidency attributed the delay to Tinubu’s directive to expand the scheme to include loans for vocational skills.

The Nigerian Education Loan Fund announced May 24 as the official date for opening the loan application portal.

Sawyerr urged students to visit www.nelf.gov.ng to apply from May 24. He explained that only students whose institutions had uploaded their data to the Fund’s dashboard would be eligible.

Requirements for applying include the admission letter from the Joint Admissions and Matriculation Board, National Identity Number, and Bank Verification Number, along with completed application forms from the website.

“The loan application process has been streamlined for easy access by eligible students. Applicants can access online support during the application process,” Sawyerr stated, highlighting that the initiative reflects the government’s commitment to investing in education.

One notable feature of the program is the absence of physical contact between loan applicants and NELFUND. The user-friendly portal allows students to submit their applications conveniently.

Sawyerr encouraged students to apply promptly to ensure timely processing. He also noted that applicants would receive monthly stipends for upkeep in addition to the interest-free loan, though the stipend amount is yet to be determined.

“The fees for the institution will be paid directly to the institution at the maximum fee per session. We will only pay for one session at a time to account for students who may drop out or change institutions,” he clarified.

Sawyerr also emphasized the role of institutions in providing the Fund with data on student fees and the involvement of security agencies to prevent fraud.

In a related development, the Federal Government has called on state governments to ensure responsible and transparent use of the matching grants for the Universal Basic Education Commission (UBEC) program.

UBEC Executive Secretary Dr. Hamid Bobboyi stressed this directive during the inauguration of a training program for accountants and auditors from UBEC and State Universal Basic Education Boards in Abuja.

Bobboyi condemned the undue pressure on financial officers by state officials, urging them to uphold integrity. The training aims to update participants on revised accounting practices and ensure effective service delivery in basic education.

Bobboyi highlighted the importance of a robust accounting system for managing the Federal Government’s UBE Intervention Fund and stressed adherence to accountability guidelines.

Director of Finance and Accounts at UBEC, Adamu Misau, noted that a new sanction regime, developed in 2022, had been approved for implementation following adequate training of financial managers.