Nigeria News

Access Bank: How Erastus Akingbola by-passed protocols to transfer about $12million, £9million offshore – Witness

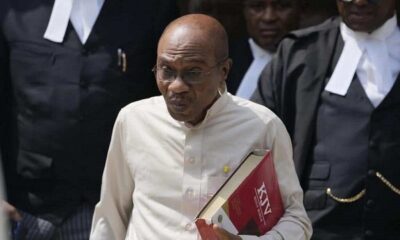

A witness for the Economic and Financial Crimes Commission, EFCC, Babatunde Aro, has narrated how Erastus Akingbola, a former Group Managing Director of the defunct Intercontinental Bank, allegedly bypassed banking protocols to transfer $11.8 million and £8.54million offshore without recourse to the bank’s standard procedures.

The EFCC witness reportedly disclosed this at the ongoing trial of Akingbola which continued on February 19, 2021 before Justice A. O. Faji of a Federal High Court, Ikoyi, Lagos.

A statement by the EFCC Head of Media and Publicity, Wilson Uwujaren, on Monday noted that Aro, who testified as the fourth witness, works with Access Bank Plc as Head, Global Compliance Advisory.

Akingbola is being prosecuted by the EFCC for an alleged N179 billion fraud committed by him while he was at the Intercontinental Bank. He is alleged to have perpetrated the fraud using suspicious financial transactions.

However, he pleaded “not guilty” to the allegations.

Testifying, Aro told the court that he was part of an audit team that investigated a number of suspicious foreign transactions, including the ones involving the $11.8 million and £8.54 million.

It will be recalled that Access Bank acquired Intercontinental Bank when it became financially distressed.

Led in evidence by the EFCC lawyer, Rotimi Jacobs, SAN, the witness who then worked at Intercontinental Bank, told the court that around November/December 2009, he was co opted into a team set up in internal audit “to review and investigate some foreign transactions”

According to him, in the course of investigating the suspicious transactions, it was uncovered that: “On the 11th March, 2009, the sum of £8.54 million was transferred from the bank’s Deutshe Bank Nostro account to a certain Messrs Fugler Solicitors on the instruction of Dr. Erastus Akingbola.

“The instruction was not signed and at that time his domiciliary account with the bank had $19 and £10,000.

“The Visa Card account was also not funded at that time, so also the naira account of Dr. Erastus Akingbola with the bank did not have the equivalent of £8.54 million.”

He further told the court that the team of internal auditors found out that the bank’s Nostro account with Deutsche Bank was debited to the tune of $9.8 million and a corresponding £7.1 million was put in the bank’s GBP Deutsche Bank Nostro account.

He said, “Another $1.98 million was observed taken from the same dollar Deutsche Bank Nostro account of the bank and a corresponding £1.4 million put in the bank’s GBP Deutsche Bank Nostro account.

“The addition of the $9.8 million and $1.98 million will give you $11.8 million while £7.1 million and £1.44 million will give £8.54 million.

“However, there were no corresponding amounts in the account of Dr. Akingbola at these times, and the instruction with which the transfer was effected was unsigned.”

He further added that “contrary to normal procedures for such transactions, there were no corresponding deductions of charges from Dr. Erastus Akingbola’s account before effecting the payments”.

Identifying the bank statements of the said transactions in Exhibit L, he noted that “the authenticated message transmitted to the correspondent bank showed the sender as Intercontinental Bank, and the receiver as Deutsche Bank.

“The ordering customer on the document is Dr. Erastus Akingbola and it shows the beneficiary bank account as Fugler’s Client Account.

“Details of charges were stated as OUR meaning the person sending will pay to both himself and the party sending the money to.”

While noting that Akingbola was the Group Managing Director of the bank at the time he gave the instruction, he stressed that the said instruction which was authorised by a manager at the bank, ought to have been declined.

He said, “Normally, an instruction without a signature will be returned to the customer, or the customer will be asked to come and sign else the bank will return it and not process it.

“Even if it is after verifying his position with the bank, the transaction will be declined on the basis of insufficient funds.”

The case has been adjourned till March 1, 2021.