Nigeria News

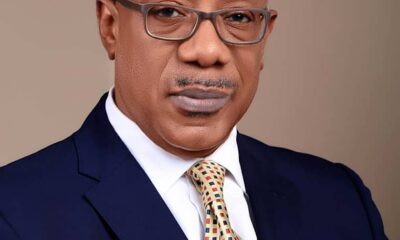

Abubakar Suleiman: EFCC grills Sterling Bank CEO over N20 billion Kogi fund

The Economic and Financial Crimes Commission (EFCC) has questioned Abubakar Suleiman, the chief executive officer of Sterling Bank Plc, and two other senior executives of the bank over the ‘hidden’ N20 billion reportedly belonging to the Kogi State government.

In August 2021, the federal anti-graft agency stated it received solid intelligence that cash alleged to be proceeds of illicit acts were in an account named Kogi State Salary Account and account number 0073572696 at Sterling Bank Plc. The funds were supposed to go to the state’s bailout fund to pay workers’ salaries, but they were allegedly diverted to an interest-bearing account.

The state government, on the other hand, has categorically disputed the allegations. The EFCC, on the other hand, claimed that the diverted funds had been recovered and remitted to the Central Bank of Nigeria (CBN), a transaction that the apex bank had acknowledged.

According to the EFCC, the apex bank informed the executive chairman of the EFCC, Abdulrasheed Bawa, that the money had been received in a letter titled DFD/DIR/CON/EXT/01/099 and dated November 9, 2021.

“We refer to your letter dated November 5, 2021, with Ref. No: CR:3000/EFCC/LS/CMU/REC-STE/VOL.4/047 on the above subject and wish to confirm the details of the receipt of the amount as stated below: Bank: Sterling Bank Plc; Amount: N19, 333, 333,333.36; Date of receipt: 04 November 2021,” The commission had said.

Even though the money is in the CBN coffers, the Kogi State government has continued to insist that it neither authorized the opening nor operated the bank account, an assertion confirmed by Sterling Bank. “Let it be known that the Kogi government has disbursed its bailout loans for which it was granted as of October 2019,” said Kogi State commissioner for Information and Communication, Kingsley Fanwo. “There is, therefore, no hidden bailout funds/loan belonging to Kogi that is capable of being returned to the CBN or frozen by order of the court. The EFCC knows this, which is why it withdrew the suit is filed in court on the bailout fund.”

Although the Kogi State Bailout Account was not formed by the state government or at its request, Sterling Bank stated that it exists in its records and is “categorized under the account type ‘Intervention Fund.’”

According to an inside source, the EFCC invited and interrogated the Sterling Bank boss, along with two other bank employees, for several hours in response to this development to obtain the true picture of the facts surrounding the stated account. After extensive questioning, the bank’s MD and other officials were discharged, with instructions to return whenever the EFCC needed them on the case.

However, it has been learned that the bank’s CEO has provided the commission with important information while the probe is ongoing.

“The bank’s officials were grilled for several hours by the EFCC on the matter and going by their statements, heads may roll soon,” a source said.

Speaking further, the source divulged, “If the bank says the account was not opened and operated by the Kogi State government, then something is fishy and the bank must answer to it.”

“Who authorized the opening of the fixed deposit account and when? Who are/were/was the signatory to the account? How much had been withdrawn from the account since 2019? And who is keeping the N666.7 million which made up the balance of N20 billion initially said to be deposited into the bailout account? These are some of the questions the EFCC is trying to unravel.”

As of press time, neither the EFCC spokesperson, Wilson Uwujaren, nor Sterling Bank had responded to The Witness enquires