Latest News

Nigerian stock market records first weekly loss in 2022

Published

4 years agoon

The Nigerian Stock market recorded its first weekly loss in the year, as the All-Share index declined by 0.16% in the week ended 11th February 2022 to close at 47,202.3 points.

This is according to information contained in the weekly stock market report, released by the Nigerian Exchange Group.

The benchmark index, ASI declined by 0.16% from 47,279.92 points recorded as of the end of last week to close the week at 47,202.3 index points, while the market capitalization followed suit to close at N25.436 trillion.

This represents the first weekly loss, after recording five (5) consecutive weeks of appreciation with a year-to-date return of 10.5% and a month-to-date return of 1.24%.

Equity market performance

A total of 1.331 billion units of shares was traded on the floor of the Exchange during the week, valued at N22.7 billion across 24,039 deals, representing a decline (in terms of volume) compared to a total of 1.785 billion shares valued at N19.614 billion that exchanged hands last week across 27,822 deals.

As usual, the Financial Services Industry led the activity chart in terms of volume of shares with 886.121 million shares valued at N10.058 billion traded in 11.563 deals; hereby contributing 66.6% and 44.31% to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 107.592 million shares worth N4.472 billion in 3,833 deals, while the Conglomerates Industry followed with a turnover of 102.192 million shares worth N198.077 million in 1,008 deals.

Trading in the top three equities by volume in the week namely Access Bank Plc, Guaranty Trust Holding Company Plc, and Fidelity Bank Plc, accounted for 316.758 million shares worth N4.353 billion in 3,476 deals, contributing 23.80% and 19.18% to the total equity turnover volume and value respectively.

In the week under review, all other indices finished lower with the exception of NGX 30, NGX Banking, NGX Pension, NGX Insurance, NGX AFR Bank, NGX AFR Div. Yield, NGX Meri Value, NGX Consumer Goods, NGX Oil & Gas, and NGX industrial Goods indices, which appreciated by 0.07%, 2.34%, 0.46%, 1.51%, 0.32%, 4.78%, 2.03%, 1.35%, 0.29%, and 0.06%, while the NGX Growth Index closed flat.

Top gainers for the week

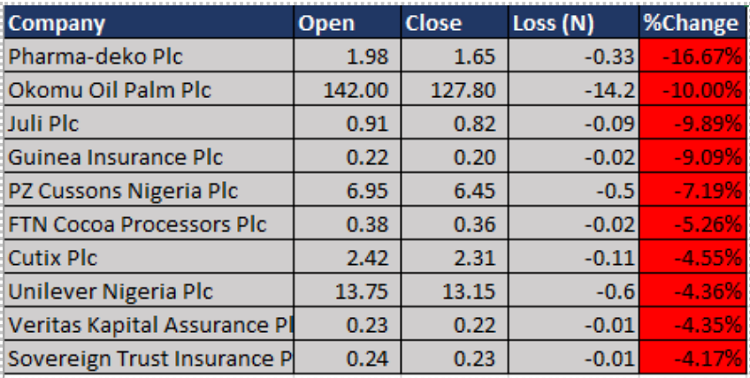

Top losers for the week

Forty-four (44) equities appreciated at price during the week, higher than Forty-two (42) equities in the previous week. On the other hand, thirty-one (31) equities depreciated in price, lower than thirty-five (35) equities in the previous week, while Eighty-one (81) equities remained unchanged higher than Seventy-nine (79) equities recorded in the previous week.

Exchange-Traded Products (ETPS)

In terms of Exchange-traded products traded on the Exchange, a total of 31,239 units valued at N37.245 million were traded this week across 53 deals compared with a total of 24,350 units valued at N574, 834.85 transacted last week in 38 deals.

The products traded during the week include, STANBICETF30, LOTUSHAL 15, VETGRIF30, NEWGOLD, VETGOODS, VETINDETF, and VETBANK.

Bonds

Similarly, a total of 79,150 units valued at N83.791 million were traded in bonds this week across 25 deals compared with a total of 61,682 units valued at N63.308 million transacted last week in 8 deals.

The traded bonds were, FGSUK2027S3, FGSUK2025S2, FGSUK2024S1, FG142037S2, FGS202386, FGS202388, FGS202394, and FG142027S1.

You may like

-

Stock Market maintains bullish trend ahead of MPC meeting

-

Nigeria’s stock market capitalization rises 5.5% in July 2023

-

Benue-born billionaire businessman and philanthropist, Dr Adejoh, to speak at the Abuja Book Launch, 2022, Ceremony

-

Nigerian Newspapers: Front pages of today’s top newspapers in Nigeria

-

Latest job vacancies in Nigeria today, October 30 2022

-

Nigerian Newspapers: Front pages of today’s top newspapers in Nigeria

BREAKING: PDP candidate, Mohammed Kasim wins Gwagwalada Chairmanship Election in FCT

‘You’re such a terrible human being’ – Lizzy Gold calls out Ekene

ABUJA COUNCIL ELECTION: Why Benue son, Dr Mo lost AMAC Chairmanship Poll

Troops arrest wife of wanted terrorist in Benue

Nigerian newspapers headlines for today, 22nd February 2026

Abuja Council poll: Final results of AMAC Chairmanship election 2026

AMAC election: Dr Mo of ADC won but they refused to announce him – Obidient Movement Coordinator, Tanko alleges

BREAKING: Maikalangu of APC defeats Moses Paul of ADC to win AMAC chairmanship election

FCT Council election 2026: Live results from Wards [AMAC]

BREAKING: APC’s Maikalangu projected winner of AMAC chairmanship election as INEC uploads early results

BREAKING: AMAC election results: APC takes early lead in Karshi as ADC stumbles